In addition to sales growth, National Friendly recorded a 12% increase in new business annual premium equivalent over the year, reflecting its continued success in delivering valuable protection solutions. The friendly society also strengthened its distribution network, reporting a 47% rise in active firms offering its policies, driven by deeper engagement with advisers and networks.

Supporting its growth strategy, National Friendly maintained an impressive record of claims and service excellence in 2024, paying out 97% of all claims within its 3-day published service-level agreement. This commitment to reliability and care underscores its dedication to protecting members during life’s most challenging moments. Furthermore, the friendly society continued to be rated highly for customer service by its members, with a Net Promoter Score (NPS) of 59.

Graham Singleton, Chief Executive, National Friendly, commented: “2024 has been another exceptional year for National Friendly. Our strong performance reflects the dedication of our teams, the trust placed in us by our members, and our close partnerships with advisers and networks. Our purpose has always been to provide peace of mind through the provision of affordable insurance solutions to as many families as we can, and these results affirm that we’re delivering on that promise.

“Over the past year, we’ve also worked hard to broaden our product offering and enhance our service levels, ensuring we continue to meet the evolving needs of those most in need of insurance solutions. The economic uncertainty faced by many UK households highlights the importance of accessible and affordable protection. Our innovative solutions, like Friendly Shield and our enhanced income protection products with a significantly optimised application journey and almost instant access to underwriters, have helped bridge this gap while keeping families financially secure during challenging times.”

Delivering on its mission in 2024, National Friendly has:

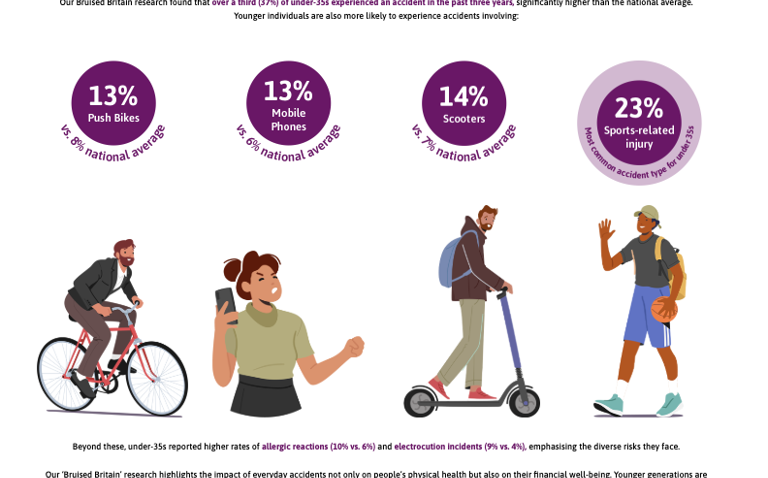

- Launched the hugely popular Friendly Shield, offering peace of mind with guaranteed benefits should the unexpected happen, covering everyday risks. Its pricing structure is both affordable and simple and aimed at individuals who may struggle to afford traditional protection products or who don’t have a need for full income protection. The policy is quick to open, taking less than five minutes, and quick to provide a benefit, with the income benefit payable after only 14 days from the date of the incident under both the accident and sickness variants.

- Delivered more product and value enhancements to its Accident Only Income Protection and changed the benefits on its Income Protection policies following input from intermediaries and customers.

- Reduced and simplified the questions on its Income Protection application, cutting the time it typically takes advisers to apply by over half, from 14 minutes to 6 minutes.

- Expanded its value-added benefits to provide all new protection customers with Friendly GP/GP+ its 24/7 virtual GP service which can be confidentially used without limit, plus additional benefits such as counselling, legal support and access to a wellbeing hub.