Fears of permanent disability and financial impacts of an accident

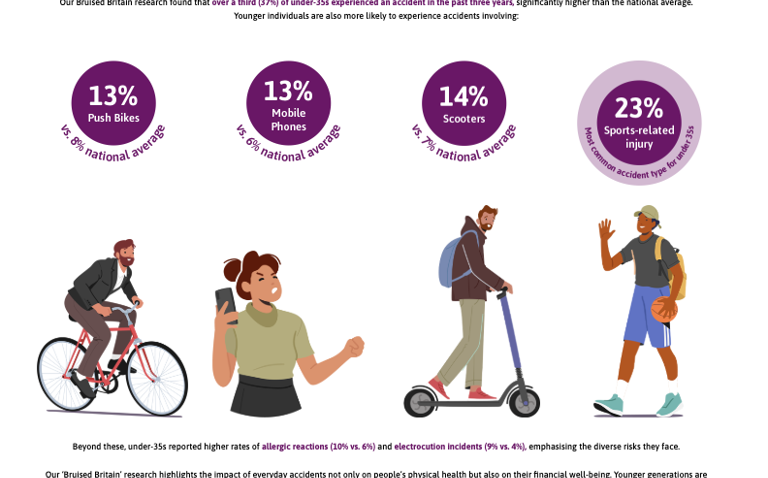

The friendly society found that almost half (46%) of British adults who are fearful cite worries about their recovery if they had an accident, and a third (34%) fear a permanent disability that could impact their future career or earnings, rising to 41% of adults under 35. In fact, the study did find that almost one in seven (15%). British adults who experienced an accident in the past three years now live with a long-term disability or health condition as a result, rising to 23% of under-35s.

Furthermore, almost a third (29%) fear not being able to work or risk losing their income or job if they have an accident (36% of adults under 35). National Friendly has also reported that over half (57%) of workers who’ve had an accident in the last three years had to take unplanned time off, climbing to almost three-quarters (71%) of those under-35s.

Worries about the NHS’ ability to provide care

Concerns extend beyond the workplace, with 1 in 3 (33% ) of adults worried about the NHS’ ability to provide care if needed and just under 1 in every 4 fearing they wouldn’t be able to support their families.

Graham Singleton, CEO of National Friendly, commented: “Our research paints a sobering picture of a nation anxious about the potential fallout from everyday accidents. Young people, in particular, are disproportionately affected, not only in terms of the frequency of accidents but also the long-term consequences. These findings underscore the importance of affordable, accessible income protection products, which offer peace of mind and financial security. At National Friendly, we’re committed to addressing this gap by providing flexible, inclusive policies that make a real difference when life takes an unexpected turn.”

National Friendly’s income protection solutions, such as Friendly Shield and Accident Only Income Protection, provide essential cover with no medical underwriting and options tailored to individual needs. With NHS pressures at an all-time high, Friendly GP+ also offers a valuable alternative—providing quick, 24/7 access to private GP consultations for the whole family, available as part of our protection products.

Ben Mason, Protection Manager, Lightblue Online said:

"These findings highlight the real financial risks that come with unexpected accidents—especially for younger clients who may not have built up financial resilience. Many people assume they’ll be fine, but the reality is that time off work, lost income, and NHS pressures can have a serious impact. Income protection products provide a straightforward, accessible way for clients to safeguard their financial stability, giving them peace of mind that they’ll have support if the unexpected happens."

For more information on National Friendly and its ‘Bruised Britain’ study, please visit www.nationalfriendly.co.uk/bruised-britain.