The Bruised Britain study found that among those who have had an accident in the last three years, over one in 10 (11%) experienced a broader mental health impact from their accident, and 5% even suffered nightmares, rising to 7% among women and 8% among those aged under 35.

Among those who work and had to take unplanned leave due to an accident, 15% reported a decline in their mental health due to financial worries, rising to almost one in five (19%) of men. Furthermore, 12% said their family relationships suffered because of financial stress put upon them as a result of an accident, rising to 15% of men.

According to the Health and Safety Executive (HSE), in the 2023/24 period, stress, depression, or anxiety accounted for 16.4 million working days lost, with an average of 21.1 days lost per case.

Graham Singleton, CEO of National Friendly, commented:

“It’s important that everyday accidents are factored into discussions on financial resilience. By reframing the income protection conversation to include mental health and family wellbeing, advisers can help clients recognise the full scope of risks they face.

“With nearly three in five (57%) of workers who suffered an accident having to take unplanned leave, the case for income protection is clearer than ever. Yet, many people still view income protection as a safeguard against extreme scenarios such as critical illness or disability, overlooking the everyday risks that could prevent them from working.”

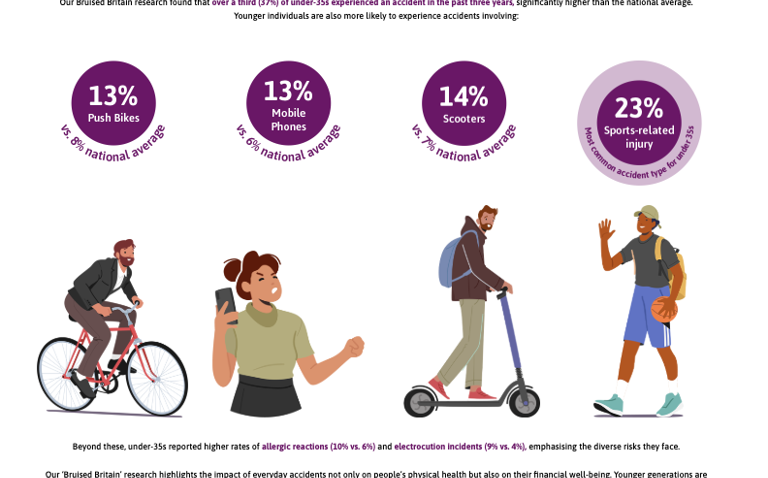

The friendly society’s research highlights the widespread impact of accidents on people’s health and finances. It was found that over the last three years, nearly a third (29%) of adults experienced an accident, with the frequency higher among younger people (37% of under-35s). Over half (57%) of workers had to take unplanned time off work, climbing to 71% among under-35s.

David Bock, Head of Protection at USAY Compare, commented:

"These findings highlight how important income protection is in supporting members. Mental health struggles and family stress can have a big impact.

By helping members understand the everyday risks they face, we can guide them to solutions like Friendly Shield, which gives essential financial reassurance during recovery.

National Friendly is committed to helping individuals and families safeguard their financial futures, no matter what challenges life throws at them. The latest member of its income protection product family, Friendly Shield, is designed with this in mind and is a simple, affordable, and quick option. It offers short-term benefits such as up to 3 months’ guaranteed income at the customer’s chosen level, fracture cover and hospital cash – all with no medical underwriting.

For more information on National Friendly and its full ‘Bruised Britain’ study, please visit www.nationalfriendly.co.uk/bruised-britain.