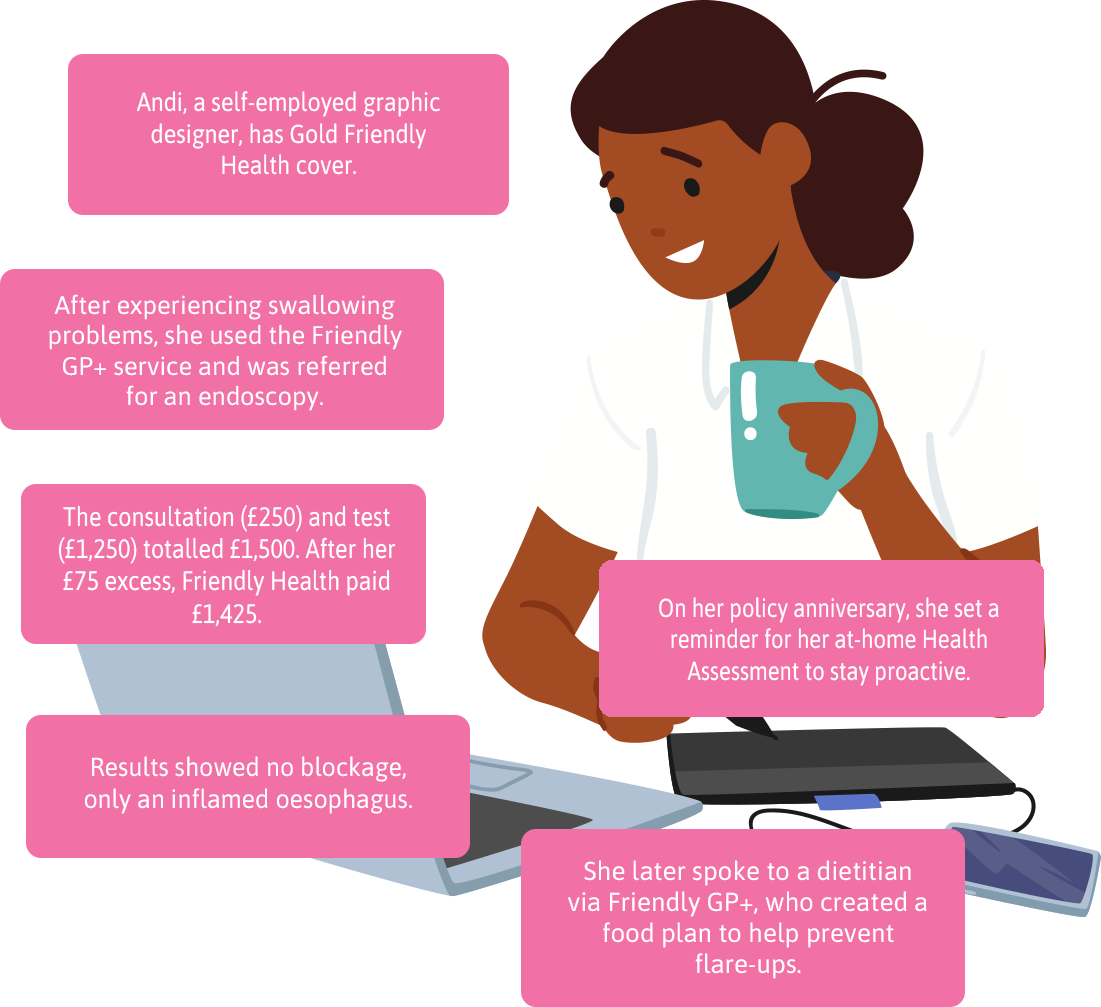

Friendly Health is an affordable, benefit-rich policy that helps you take control of your health today, and gives you reassurance if your health changes tomorrow and you need a diagnosis.

It’s designed to be simple, accessible and easy to understand, while providing preventative and diagnostic medical support so you can stay well, identify problems early, and recover quickly and smoothly.

Available with three levels of cover - Gold, Silver, Bronze - to suit your individual needs and budget.

It’s quick to apply for and quick to benefit from putting proactive health and wellbeing front of mind.