A fracture is a broken bone, the same as a crack or a break. A bone may be completely fractured or partially fractured in any number of ways (crosswise, lengthwise, in multiple pieces).

The fracture must be diagnosed by a Consultant.

Categories of payment

The payout you’ll receive will be determined by which category of fracture you've suffered.

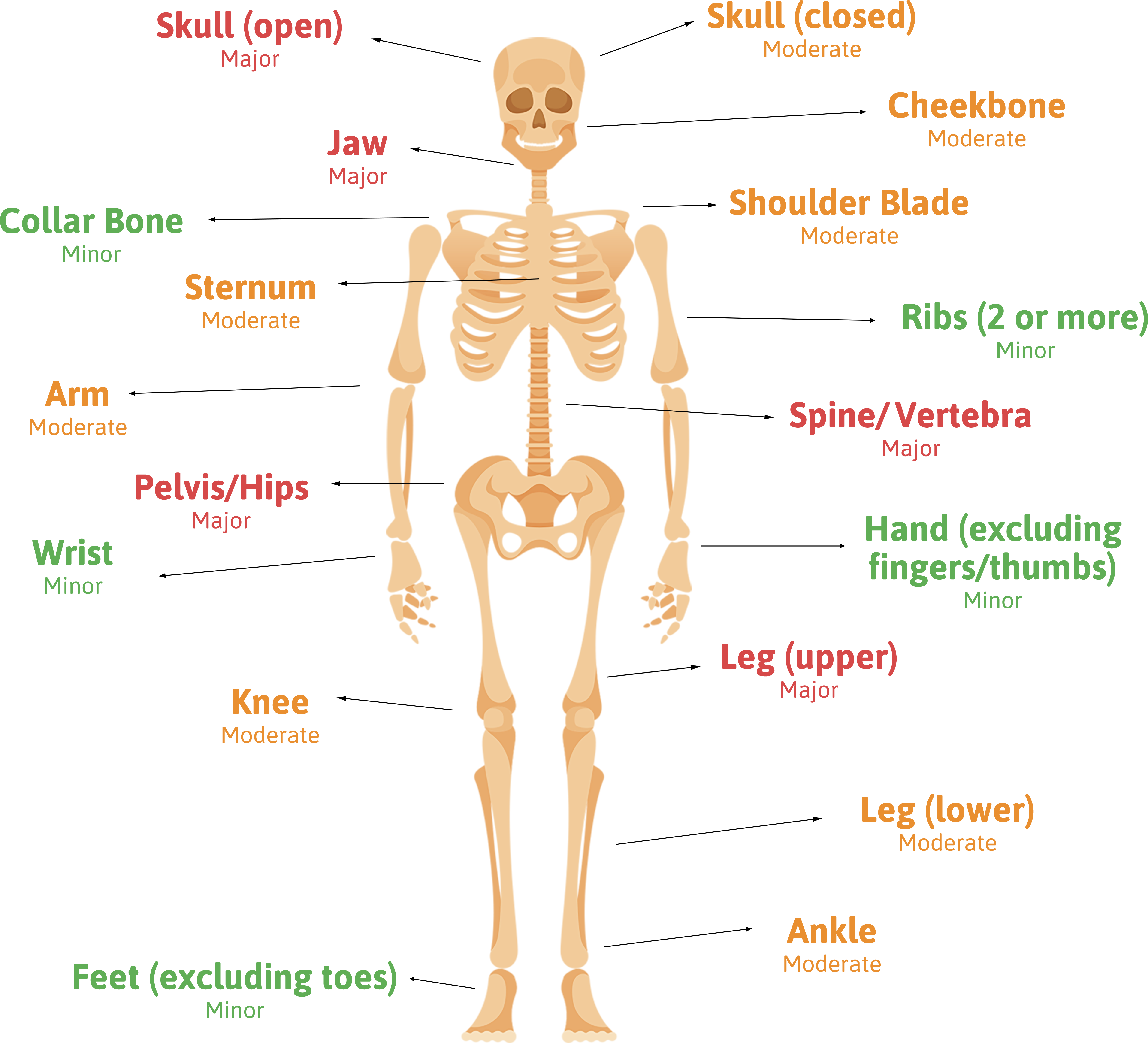

There are three categories of payment depending on the severity of the fracture:

- Mild - £1,000 payment for each fracture

- Moderate - £2,000 for each fracture

- Major - £3,000 for each fracture