We’ve refined our Hazardous Pursuits cover for Accident Only Income Protection and Income Protection policies — making it fairer, simpler, and easier to understand.

What's new?

- Clear eligibility rules: Amateur participants are now covered as standard.

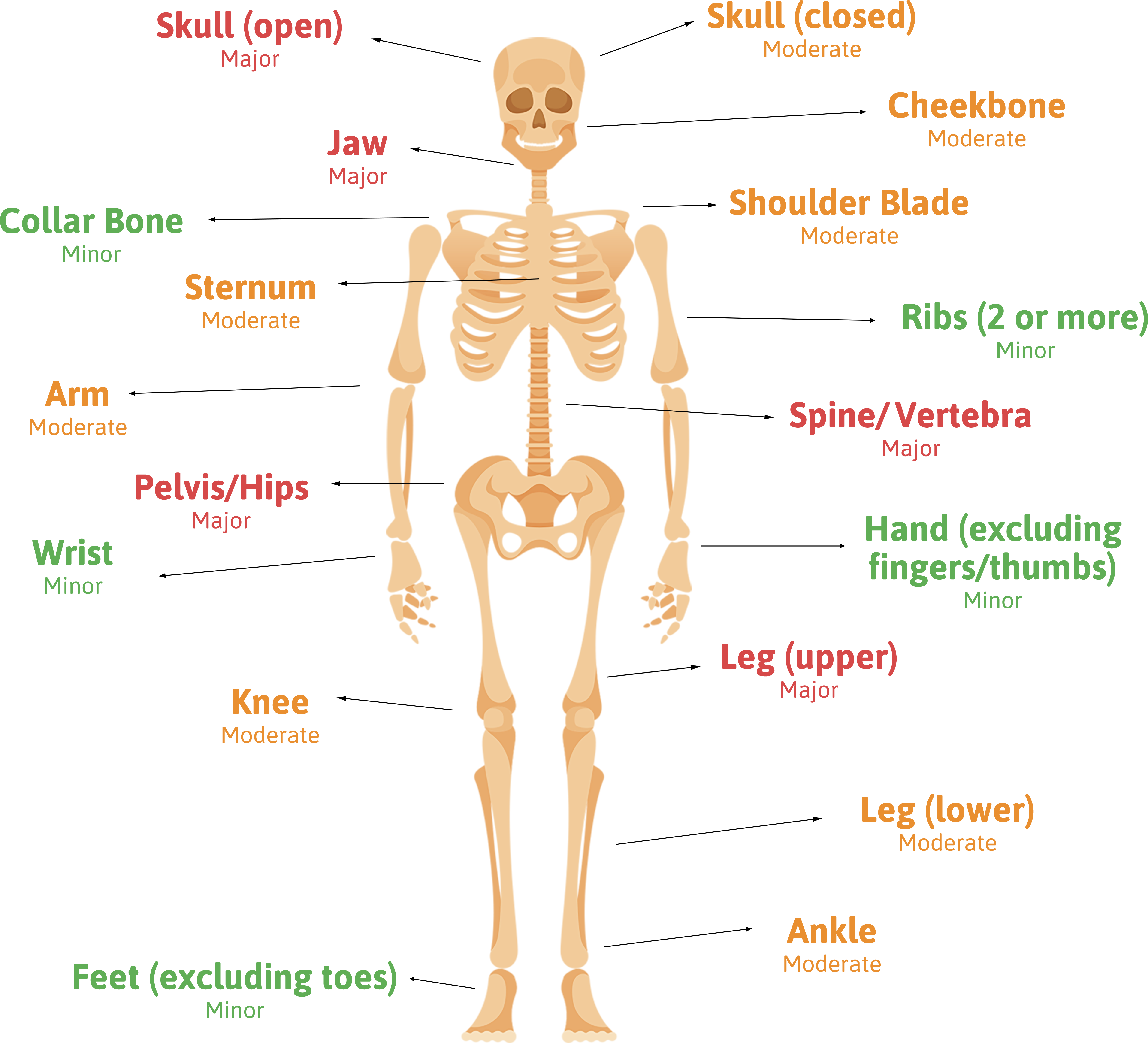

- More inclusive team sports cover: Rugby, American football, and more, are now covered under our standard terms - even for fracture claims.

- Simplified martial arts and combat sports cover: Training is covered as standard. Amateur bouts are covered but require enhanced cover.

- Straightforward guidance: It’s now crystal clear what’s covered, what's not, and when enhanced cover is needed.

Why it matters

Our updated approach means faster, simpler underwriting, with fewer questions, no delays for assessments and a smoother experience for you and your clients.

We continue to lead the market with one of the simplest hazardous pursuits policies, offering standard cover for activities like aviation and diving (up to 50 metres), and now even offering fracture cover for contact sports.

Explore our full updated list here or contact us if you have any questions.