Friendly Shield provides short-term essential protection against unexpected accidents, and has a popular option to cover sickness, too.

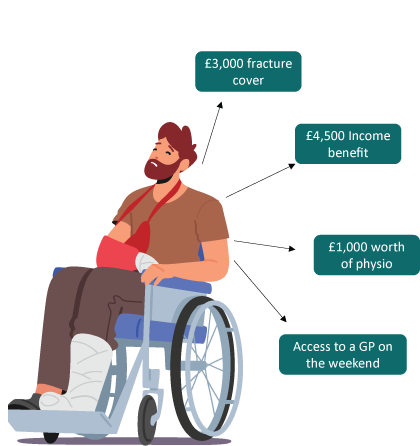

It is designed to provide a number of valuable protection benefits including an income benefit, fracture cover, and both natural and accidental death benefit, plus a rehabilitation benefit to help your clients get back to work sooner following an accident. It also provides access to a doctor or dentist through its free Friendly GP+ and Friendly Dentist+ services.

Benefits kick in after only 14 days – making the policy accessible far sooner to help meet their needs.

Friendly Shield is simpler than other protection products on the market. It’s quick to apply for and quick to benefit from.