A fracture is a broken bone, the same as a crack or a break. A bone may be completely fractured or partially fractured in any number of ways (crosswise, lengthwise, in multiple pieces).

The fracture must be diagnosed by a Consultant.

Categories of payment

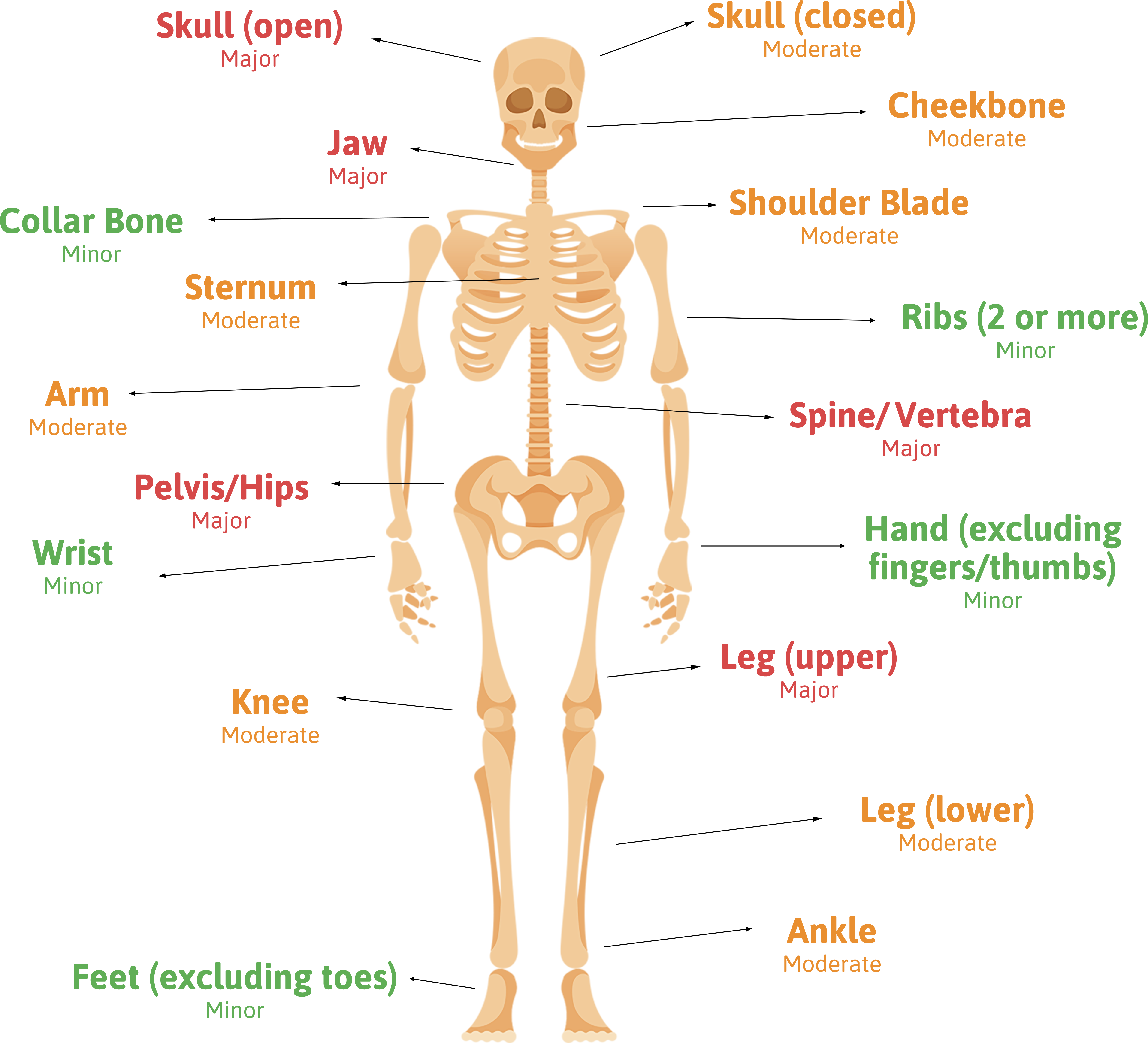

The payout your client will receive will be determined by which category of fracture they've suffered.

There are three categories of payment depending on the severity of the fracture:

- Mild - £1,000 payment for each fracture

- Moderate - £2,000 for each fracture

- Major - £3,000 for each fracture