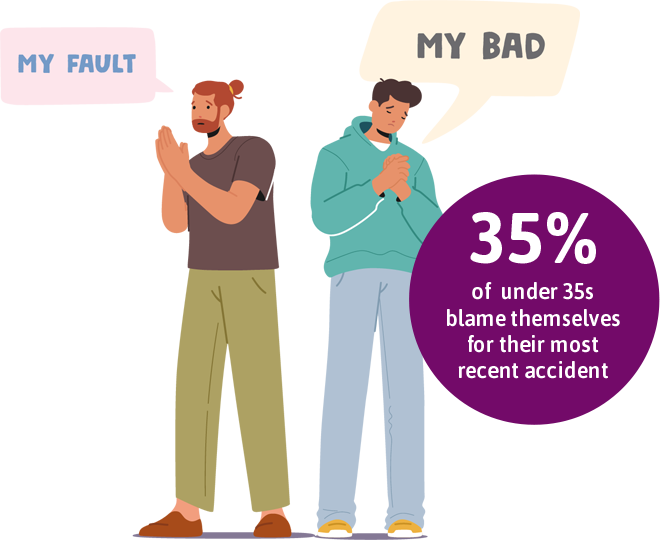

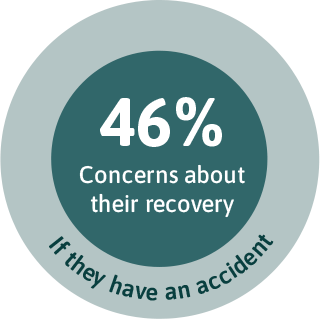

One in four (26%) adults live in fear of having an accident, a figure that rises to 31% among women and 34% among young people (aged 18-34), reveals our Bruised Britain research.

In fact, when it comes to their personal safety and the likelihood of having an accident day to day, over half (51%) consider themselves to be ‘risk-averse’.

Brits who think they will have an accident expect to have an average of eight accidents in a lifetime, but 14% think they may have nine or more. Optimistically 13% of British adults don’t think they will ever have an accident during their whole lifetime.