Our Over 50s Life Cover stands out in the market with the reassurance and support it offers your clients – including full cover after just 6 months, subject to 2 simple questions.

Full cover after just 6 months, subject to 2 medical questions

Double the payout if they die from an accident

Friendly GP+: Fast 24/7 access to a GP for the whole family – as soon as the policy is opened

Benefit Builder option, to keep your client’s cover affordable but growing

At a time when many people are struggling to speak to a GP, Friendly GP+ is a game-changer.

It provides confidential, fast, 24/7 access to a GP via phone or online, for the

whole family, and it’s completely free.

The GP can provide diagnosis, advice, fit notes, prescriptions, access to qualified physiotherapists and referrals for treatment to improve general health and wellbeing. Friendly GP+ also

includes other support services such as counselling and legal support.

24/7 virtual GP service

Legal information and support

Private Prescriptions

Manager support

Open Referrals

Money and debt help

Physiotherapy

Health and wellbeing guidance

Counselling

Wellbeing hub

Every policy comes with free access to our wellbeing hub. It’s called Friendly GP+ and it can be accessed over the phone or online 24 hours a day, 7 days a week.

We’ll give the full details on how they can access it when they take out a policy or

they can go to our Existing Members page to find out more.

"One of the best GP experiences I’ve had. My doctor was super friendly, patient, understanding, made me feel at ease and gave really good advice."

If your client answers two medical questions correctly they could have full cover in only six months – one of the shortest qualifying periods on the market.

They’ll also be offered an increased payout. If they’d rather not answer the questions, we still guarantee to cover them but with a two year qualifying period.

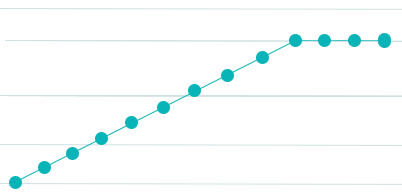

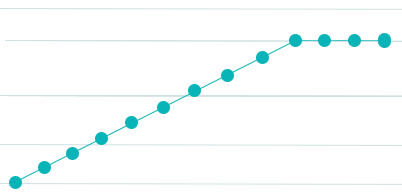

With Benefit Builder, your clients can choose to pay a cheaper premium for a lower level of cover

today, which increases affordably over time.

The premium and cover will increase by 10% each year for the first ten years. By year 11

the cover will have doubled. This provides an element of flexibility and helps

keep cover affordable for your client.

So, for example, if their starting premium is £20 a month, then in year 2 it will be £22, in year 3 it will be £24 and so on until it reaches £40 a month in year 11. Their payments will then be fixed at £40 a month for the remainder of their policy.

Likewise, if their starting cover amount is £5,000, in year 2 it rises to £5,500, in year 3 it will be £6,000 and so on until it reaches £10,000, twice the starting amount, in year 11. The payout then stays at that level.

Our quote tool helps to show how Benefit Builder works.

If your client dies from an accident, we’ll double the payout amount (assuming they die as a result of their injuries within 30 days of the accident).

Guaranteed acceptance, even for those with existing medical conditions.

Your clients don’t have to answer any medical questions and they’ll still be guaranteed cover.

If they die during their qualifying period but it wasn’t due to an accident, we’ll pay back all the payments they’ve made.

A terminal illness benefit where we can pay half the payout directly to your client if they receive a terminal diagnosis two years or more from taking out the policy.

If your client dies from an accident, we’ll double the payout amount (assuming they die as a result of their injuries within 30 days of the accident).

We offer guaranteed cover to non-smokers aged 50 to 80 or smokers aged 50 to 75.

They can choose to answer our two medical questions or not.

If they don’t answer them, they’ll be offered a two-year qualifying period as standard.

If they do choose to answer them, they could be offered an increased payout and only a six-month qualifying period.

Our standard qualifying period is two years. But if your clients answer the two medical questions we ask, this could change to just six months.

They’ll have to make the payments for their policy for the rest of their life.

Every policy comes with free access to our virtual GP service. It’s called Friendly GP and it can be accessed over the phone or online 24 hours a day, 7 days a week.

We’ll give the full details on how they can access it when they take out a policy or they can go to our Existing Members page to find out more.

Contact our specialists on 0333 014 6244 and we can help you with any questions you have.

Applying is quick and easy.

Get access to our quote calculators, online application forms and useful collateral.

0333 014 6244

Monday to Friday / 8am – 6pm

Inflation will mean any payout will have less buying power in the future.

Depending on how long your client lives, they could pay more in than the value of their payout.

If your client cancels their policy after the first 30 days, they’ll get nothing back.

This is not a funeral plan and does not guarantee to pay the full costs of a funeral. Instead, it pays out a lump sum that can be put towards it, or any other expense or treat.